From January

Tax return filing deadline

Tax return filing deadline

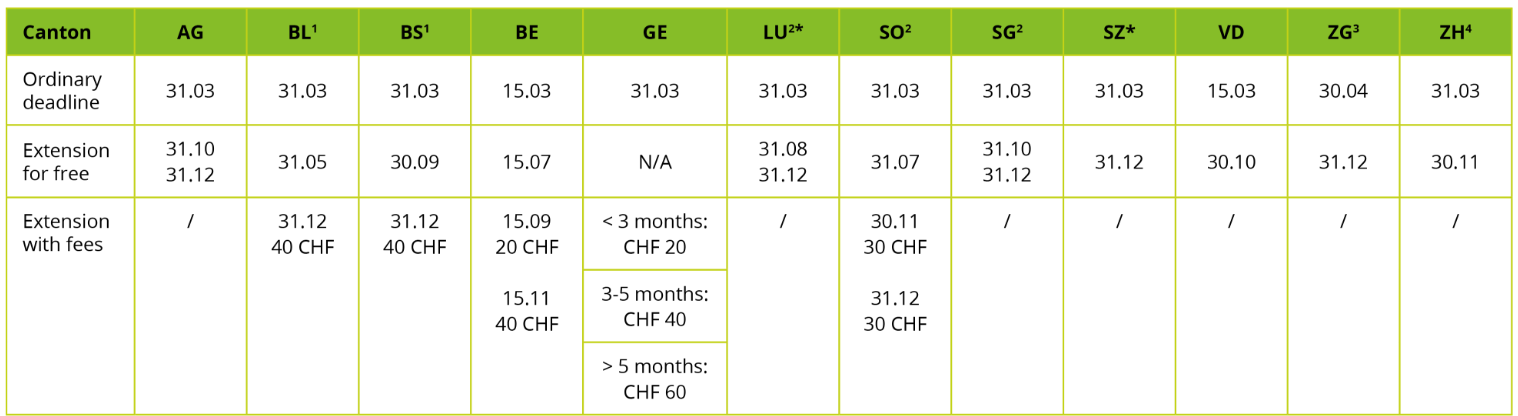

Deloitte will automatically handle the deadline extension for filing your tax return. We therefore kindly ask you to forward us the signed POA and your Swiss tax return forms (in case you received them directly) to enable us to extend your deadline. Please note that the extension of your tax return filing deadline does not have an impact on the tax payment deadline. Kindly note that the fees above are issued by the Swiss tax authorities, however Deloitte may charge you an additional service fee for the deadline extension.

In case you are obliged to file a Swiss departure tax return, tax payment and filing deadline are 30 days after deregistration from Switzerland. The filing deadline can be extended up to 12 months in most of the cantons, however the payment due date will not change. We therefore recommend making your tax pre-payments before you deregister from Switzerland or soon after.

Should Deloitte be authorized to prepare your Swiss tax return, please forward the relevant tax return forms to your Deloitte professional, should these forms be sent to your address. These forms contain important information required to extend your filing deadline.

Deloitte will automatically extend your deadline until the last viable date.

1 Additional deadline extensions until 31.03 of the following year or even longer are possible.

BL allows the filing of the tax return before 31.05 without actively requesting a deadline extension and charges CHF 40 for extensions/filed tax returns as of 01.06.

BS charges a fee for extensions after 01.10 or if a reminder was issued (e.g. deadline extension request after the passing of the ordinary deadline 31.03).

2 Deadline extension until 31.12 only possible with written request and reasoning of the delay.

3 Deadline extension over 31.12 possible, the authorities will charge a fee of 35 CHF.

4 No further deadline extensions will be granted. The authorities usually allow filing the return by 31.01 of the following year, however they send reminders (no fees) in the meantime.

* Please note that some cantons do not grant any further deadline in case a reminder was issued.

About Me

About Me

If Deloitte is assisting you with the preparation of your Swiss tax return, then please note the following:

At the end of the tax period, we will contact you to ask you to complete your ‘About Me’ tool. This is an online questionnaire which, when filled out, should give us all the information we need to complete your tax return. We will typically send you our questionnaire at the beginning of the new year (January or February).

The questionnaire can be accessed via the GA Portal. Click here for an overview of the ‘About Me’ and how to complete it.

Before submitting your tax data, please check to make sure that the information is complete.

Deloitte will only start working on your return once you have submitted a complete set of tax data. Should we notice that any information is missing or unclear, we will reach out to you via our portal to request the additional details.

We’ll let you know once your tax return is completed so you can review and approve it via the GA Portal.